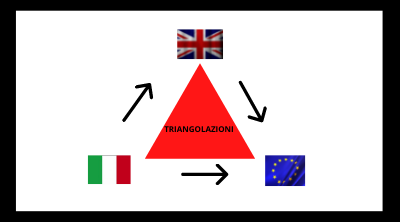

VAT TRIANGULATION PRATICAL CASES

A triangular operation is an operation in which: There is the simultaneous presence of three different economic operators, located in different EU or non-EU states; The assets are the subject of two separate transfer contracts; To carry out the two different transfers, a single movement is carried out: the asset being sold is delivered [...]