A triangular operation is an operation in which:

- There is the simultaneous presence of three different economic operators, located in different EU or non-EU states;

- The assets are the subject of two separate transfer contracts;

- To carry out the two different transfers, a single movement is carried out: the asset being sold is delivered directly by the first transferor to the transferee or final recipient. For there to be a triangular operation, the good must transit without entering the material availability of the first transferee (the E-commerce/Marketer site).

There are numerous triangular operations depending on the business scheme/model that we are going to build with the subjects involved. Below we offer some recurring examples:

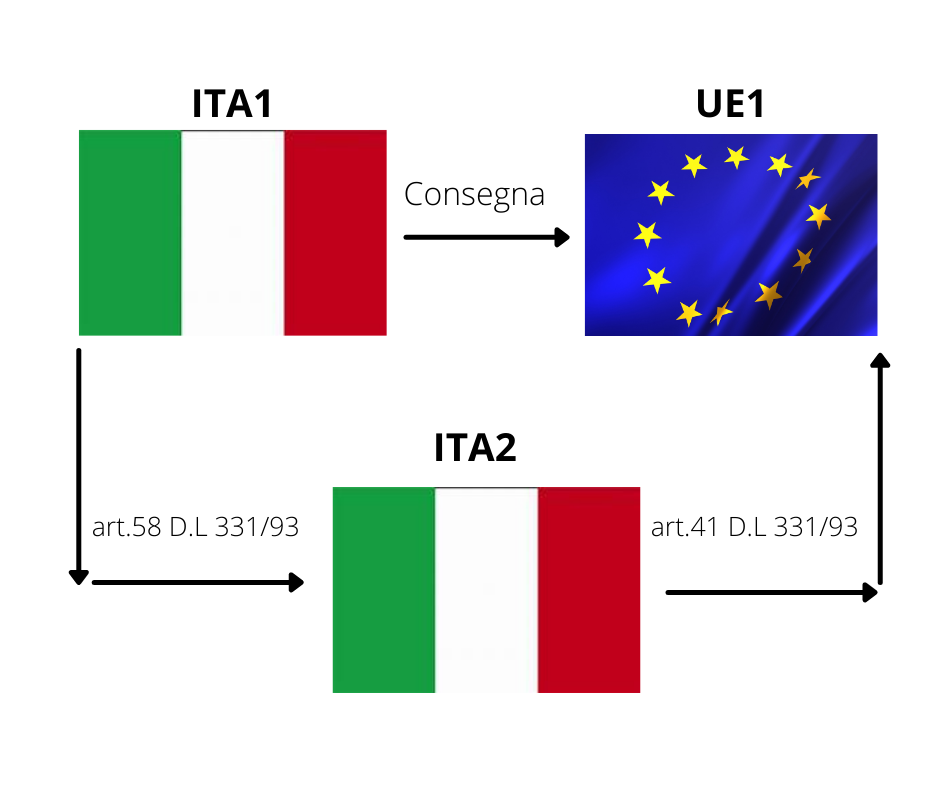

National triangulation (In Italy)

IT1 Make an internal transfer with a non-taxable invoice pursuant to art. 58 of the Legislative Decree. 331/93 (This is because the goods do not transit through IT2 but go directly to UE1. IT2 then carries out an intra-community transfer and issues a

non-taxable tax ex. Art 41 Legislative Decree 331/93. The invoice must include the words “non-taxable invoice”. The VAT will then be paid by the transferee/final recipient.

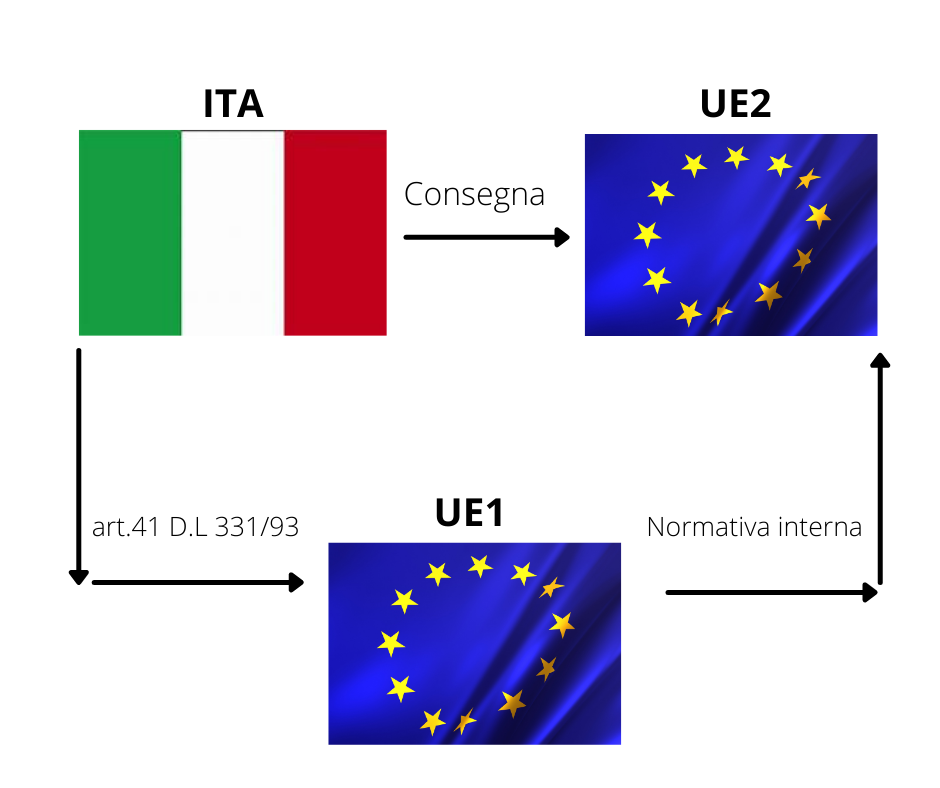

Triangulation with a EU subject

ITA carries out an intra-community transfer art. 41 Legislative Decree 331/93 and issues a “non-taxable” invoice.

ITA fills out the Intrastat form for supplies, indicating the data of the UE1 customer and the destination in the UE2 country.

Invoicing between UE1 and UE2 is subject to the rules of the internal regulations of UE1 towards UE2.

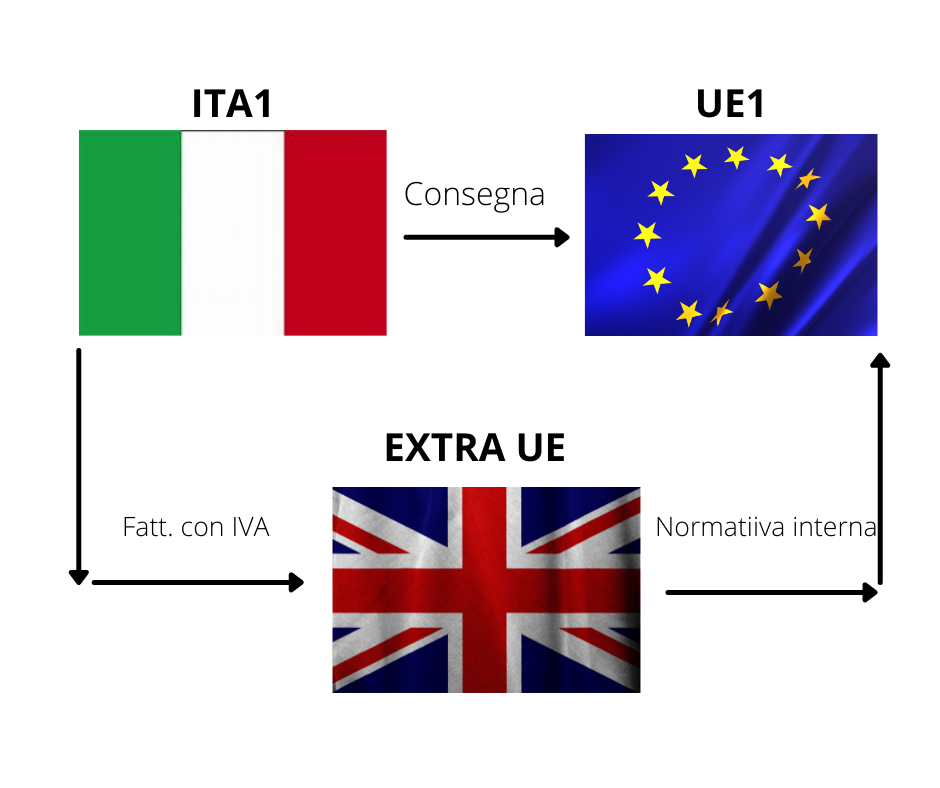

Triangulation with a non-EU subject (case 1)

ITA issues an invoice applying national VAT to the NON-EU customer (the non-EU buyer in this case cannot request a refund of the tax pursuant to art. 38-ter of Presidential Decree 633/72 because he is carrying out a territorial taxable operation.

In fact, the good does not leave Italy and its destination will be another EU country.

If NON-EU has a tax representative in Italy: ITA will issue a “non-taxable” invoice art.58 Legislative Decree 331/93

If NON-EU has a tax representative in the EU: ITA will issue a “non-taxable” invoice art.40 Legislative Decree 331/93.

To conclude EXTA UE 1 invoice to UE1, based on its internal regulations.

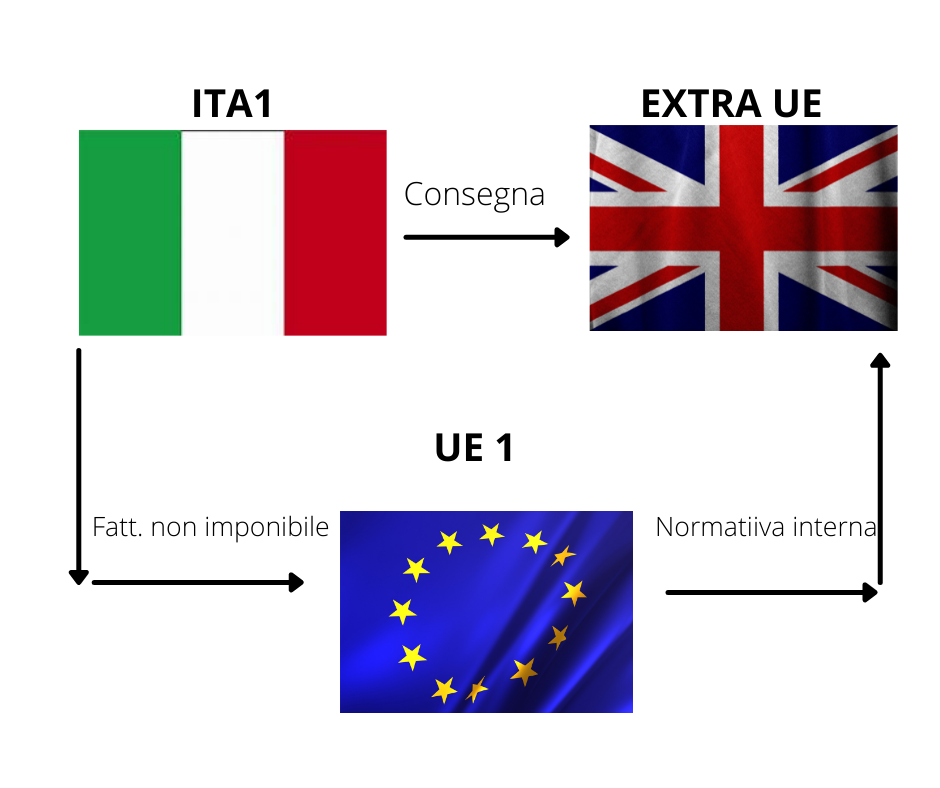

Triangulation with a non-EU subject (case 2)

ITA issues a non-taxable invoice pursuant to art.8co.1 letter a) of Presidential Decree 633/91 to the EU customer on condition that the latter (ITA) carries out an export to EXTRA EU, with a customs proof document, taking care directly or through transporters on his behalf, the delivery of goods outside the EU. The EU then invoices NON-EU based on its internal regulations.

Special case: if the delivery of the goods takes place in Italy and not outside the EU, the operation is subject to Italian VAT because the operation is territorially relevant in Italy and therefore an indirect export does not take place.