Starting from 01.01.2021, companies with registered office in Great Britain found themselves, from one day to the next, being considered for tax purposes as non-EU entities rather than EU entities. From a practical point of view this essentially means 2 things: moving goods (goods or capital goods) or personnel from Great Britain to Italy or vice versa is no longer as easy as it used to be.

The movement of goods:

For example, if an Italian or UK company wants to move goods between the two countries through a common sale, the physical passage of the goods from one country to the other is blocked at customs. To allow the good to cross national borders, the importer of the good must pay the VAT to customs (at a later time the VAT can be recovered by registering the customs document in the accounts). In addition to paying VAT, if applicable, it is also possible to pay any duties on some types of products.

The movement of people:

People’s movements have also been strongly influenced by Brexit: while previously British citizens were EU citizens, free to move within the EU, they are now non-EU citizens and are therefore subject to greater restrictions than before. A citizen of the United Kingdom who wants to come to Italy to work must have a valid residence permit (we will not delve into the topic of work now, as it is not the focus of this article).

From a tax point of view, the rules that impact every single operation (purchase or sale of goods or services) change considerably. The Italian company that has relations with the United Kingdom now finds itself having to face some doubts:

If I sell a certain good to a certain UK customer (or provide a service), what rate of VAT do I apply? And what is the correct wording of the legislative references that I must include on the invoice?

There are many questions and doubts that arise and it is specifically necessary to examine each situation with the support of a specialized professional. In this article we cannot replace the specialized and qualified advice of the professional, however we can provide some guidelines for knowing how to orient yourself in the tax discipline in relations between Italy and the United Kingdom.

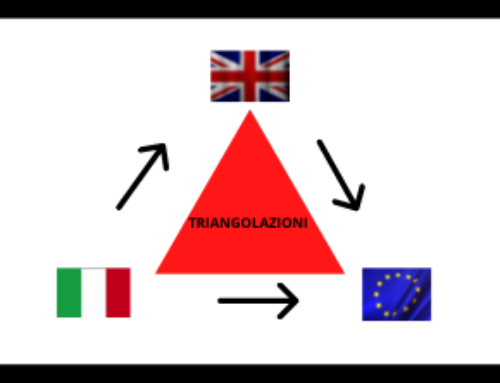

To summarize, we can say that Brexit has led to the split of the European Union into 2 markets that operate with distinct rules, especially from the point of view of VAT:

- the EU country market

- We group the United Kingdom (UK) market together with everything that is not Italy or the EU and call it Non-EU.

Let’s now put ourselves in the shoes of an Italian company that has to invoice an English company. The most common cases we find in practice are the following:

Italian company that sells goods to UK customers (B2B)

While before Brexit, an invoice was issued without applying Italian VAT pursuant to art. 41 DL 331/93 and it had to include the words “operation subject to reverse charge”.

After 01.01.2021 if we are selling to a UK company customer we are selling to a non-EU customer and therefore we are effectively carrying out an export pursuant to Article 8 of Presidential Decree no. 633/72.

Exporting a good means taking it out of the European Union. This operation involves the issuing of an invoice without applying VAT (exports are in fact “non-taxable” operations/ “operazione non imponibile”), VAT will be paid by the buyer of the goods in the country of destination).

Italian company that sells goods to private UK citizens (B2C)

However, with reference to distance sales carried out by an Italian VAT-taxable transferor to a private individual resident in the United Kingdom, the ordinary export regulations provided for by Article 8 of the Presidential Decree apply. 633/1972.

A non-taxable invoice/ “operazione non imponibile” must therefore be issued pursuant to the aforementioned article 8 and it is necessary to prove that exportation has taken place. Therefore, although not mandatory, it is advisable to issue the invoice anyway as it is a document normally required at customs for export purposes. There is obviously an obligation to register the operation in the register of fees (“corrispettivi” in Italian)vif the invoice is not issued or in the register of invoices issued.

Italian company that provides services to UK customers (B2B)

Before Brexit, an Italian company selling a certain service to a UK company did not have to apply VAT on the sales invoice. Both the provider and the EU client also had to be registered with VIES. The issuing of the invoice by the Italian entity was outside the scope of VAT pursuant to art. 7-ter of Presidential Decree no. 633-1972/ “operazione fuori campo IVA” and where to report the ‘‘reverse charge” annotation.

After the United Kingdom has changed from being an EU subject to a non-EU subject, selling a service to a British person means that this operation always involves the issuing of an invoice by the Italian subject outside the scope of VAT pursuant to art. 7-ter of Presidential Decree no. 633/1972 with the annotation of ”transaction not subject to VAT’ instead of ‘transaction subject to reverse charge”. The non-EU subject will have to issue a self-invoice (if there is such a regulatory provision in his country). For further information, read the article (direct e-commerce).

Italian company that provides services to UK citizens (B2C)

Before Brexit, the Italian company (provider) had to proceed with the opening of a tax representative. That is, he had to identify himself directly to the UK Revenue Agency. He then had to proceed with the application of British VAT to the private client. There was no obligation to submit the Intrastat lists nor to register with the VIES.

With the advent of Bexit, selling a service to a British citizen involves verifying the tax obligations that the Italian company must fulfill to enter and sell on the UK market to private individuals. The opening of a tax representative or direct identification in the United Kingdom are the possible ways.