INCOME STATEMENT AND TAX ADVICE

We manage on behalf of companies or private customers everything related to tax compliance, supporting company growth also from the point of view of tax savings.

Our advice is also aimed at private individuals residing in Italy with properties and financial assets abroad, or our compatriots residing abroad but with assets and financial assets in Italy.

Standard tax services and our tax advice

- Drafting of tax returns (IRES, IRPEF), VAT, IRAP and electronic submission

- Assistance and control of communications of irregularities (“avvisi bonari”) and tax assessments

- Assistance in tax litigation

- Drafting of withholding tax returns (770) and forms (“certificazione unica”)

- Property taxes (IMU) and other indirect taxes

Special tax services

In these years of activity we have been able to interpret the requests of our customers operating in different sectors and in a market in constant evolution and innovation. Among the special services in the tax area, we can now offer:

- Tax planning consultancy and training

- Tax return of individuals residing in Italy with properties and financial assets abroad

- Tax return of private Italian citizens residing abroad with properties and financial assets in Italy.

- Advice and assistance in the management of short-term rentals

- Consultancy and assistance in tax management of e-commerce web sites

- Consultancy and assistance for farms, livestock farms (rental agreements of rustic and relief funds)

Potrebbe interessarti anche:

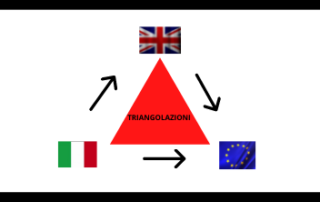

VAT TRIANGULATION PRATICAL CASES

A triangular operation is an operation in which: There [...]